Spectroscopy: Still Important and Surprisingly Robust

Industry expert Lawrence Schmid presents his annual overview of the market in the laboratory analytical and life science instrument industry. Strong growth in Asia and continued growth in North America and Europe are promising signs for the industry in 2007 and beyond.

According to Instrument Business Outlook (IBO) — a publication of Strategic Directions International, Inc. (SDI), which is a consulting and market intelligence firm specializing in this market — the total worldwide market for analytical and life science instrumentation and related aftermarket and service revenues was estimated at $32.8 billion in 2006. This represented an overall increase in industry revenues of 6.5% from 2005. As with the recent past, some uncertainty still persists. The world continues to struggle with high oil prices; political turmoil persists in the Middle East; and the political situation in the U.S. might portend changes in government funding and attitude toward international trade and investment. The pharmaceutical industry appears to be entering a period of profound change as it relates to R&D, manufacturing logistics, pricing, and marketing approaches. The long-term impact on the laboratory analytical industry has yet to be determined. And will China and India prove to be the "horn of plenty" that many desire? With all this in mind, SDI still projects a similar but slightly lower overall industry revenue increase in 2007 of just over 6%.

The year 2006 was characterized by moderate shifts in the focus of instrument companies occasioned by changing demand conditions in North America and Asia. More emphasis is now being given to opportunities across Asia, especially in China and India, and because Japan's economy has improved significantly. North America, while still the largest instrument market, demands less attention as growth will come elsewhere, but customer satisfaction cannot be shortchanged. Thermo Electron's (Waltham, Massachusetts) acquisition of Fisher Scientific is designed to address customer needs in a holistic manner, by offering one-stop shopping. And while big pharma might not be the bonanza of former years, the rest of pharma and biotech in general offer many opportunities. A host of fast liquid chromatography (LC) product introductions will likely impact the mass spectrometry (MS) market, as LC–MS instruments will have significantly enhanced sample introduction. The European Reduction in Hazardous Substance regulations (RoHS) went into effect and the X-ray fluorescence (XRF) market boomed as manufacturers worldwide worked to "get the lead out" of their circuit boards. Thermo Electron benefited greatly from its acquisition of handheld XRF manufacturer Niton, and others like Bruker BioSciences (Billerica, Massachusetts) joined the fray. Agilent Technologies (Palo Alto, California) bought out its joint venture partner Yokogawa Analytical to enhance its prospect in Japan and for inductively coupled plasma (ICP)-MS, while X-Rite (Grand Rapids, Michigan) and Amazys merged to change the market dynamics in color measurement. Actually, for an established industry, 2006 was a momentous year.

There is also a growing interest in the aftermarket aspect of the industry revenue mix, which includes such areas as consumables, software updates, and accessories. This is in recognition of the growing importance of those areas as the market expands and matures. In fact, in some market segments, the aftermarket is growing faster than instrument system revenues and is often more profitable. So it should be noted that all the revenue projections in this article include the total mix of revenue sources: instrument system sales, aftermarket, and service.

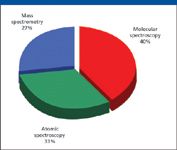

Figure 1: 2006 spectroscopy market by sector ($7.2 billion).

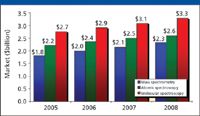

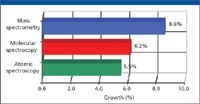

The spectroscopy market can be segmented into three distinct sectors: molecular spectroscopy, atomic spectroscopy, and mass spectrometry. The applications of the techniques included in each sector and their prospects differ significantly, even within each sector. Worldwide revenues for all spectroscopy segments is estimated at $7.2 billion for 2006, or about 22% of the entire laboratory analytical and life science instrument market. The overall spectroscopy market is estimated to have grown 7.2% in 2006, over a full percentage point better than what we had forecasted last year. SDI projects 2007 growth for the spectroscopy market to be similar to 2006, increasing about 6.5%, which suggests that this market actually will exceed total laboratory market growth, as it did in 2006.

Molecular spectroscopy techniques account for about 40% of the spectroscopy market, although many diverse techniques are represented that address a wide range of applications in almost every industry category. Atomic spectroscopy is the second largest sector at almost 33%, while MS represents slightly more than 27% of spectroscopy revenues. Please note that LC and gas chromatography (GC) front-ends to mass spectrometers and their associated aftermarket and service revenues are not included in market revenue estimates.

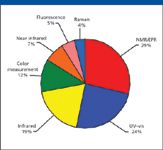

Figure 2: 2006 molecular spectroscopy market by technique.

Molecular Spectroscopy

The market for molecular spectroscopy is estimated at $2.9 billion for 2006. Overall, the total revenues for all categories of molecular spectroscopy grew 5.9% in 2006. However, there were significant differences in growth among the various instrumental techniques, led by the continuing success of the nuclear magnetic resonance (NMR) segment. No single technique dominates this market, but three segments — NMR, UV–vis, and infrared (IR) — account for slightly more than 72% of the overall molecular spectroscopy market.

Molecular spectroscopy instruments are especially focused on the important life science industries, including the pharmaceutical, biotechnology, and the agriculture, food and beverage industries, which account for about 34% of the market. Organic chemicals, academia, and government sectors account for an additional 30% of revenues, much of which is also life science–oriented. But molecular spectroscopy techniques have an enormous range of applications, so they can be found in every industry segment, including environmental testing and polymer manufacturing.

Figure 3: 2006 atomic spectroscopy market by technique.

Although NMR spectroscopy is the largest segment of the molecular spectroscopy market at well over $800 million in annual revenues, it is also one of the fastest growing sectors, still increasing at around 10% annually. NMR is an important technique that provides information on the structural analysis of organic molecules, particularly proteins. Some of the demand in recent years has been fueled by the availability of much more powerful instruments with new features and unparalleled performance. These new instruments incorporate extremely powerful superconducting magnets to improve upon analytical performance that is already very high. These new instruments also carry very high price tags, which contribute to excellent revenue gains each year. However, recently there has been renewed interest in the development of midrange instruments (400-MHz units) that are lower cost alternatives to these expensive instruments while providing significantly better resolution than existing 300-MHz instruments.

The NMR market comprises a number of related instrument types, including high-field NMR, hyphenated NMR, low-field (fixed-magnet) NMR, imaging NMR, and electron paramagnetic resonance (EPR). High-field NMR and hyphenated NMR (mostly LC–NMR) are pharmaceutical- and biotech-oriented with a focus on structural analysis. Low-field instruments are designed for quality control application, especially for moisture and fat-content analysis in foodstuffs. NMR imaging systems are applicable in clinical and biotech settings for combined imaging and spectral analysis of samples and organisms. EPR is the only technique that can identify unpaired electrons unambiguously, which makes it a useful technique for the analysis of free radicals, transition metals, and material defects. All of these techniques exhibit growth of 7–10%. High-field NMR is by far the largest segment at around 70% of the market.

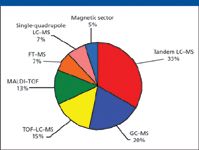

Figure 4: 2006 MS market by technique.

UV–vis spectrophotometers make up the second largest segment of the molecular spectroscopy market, but also one of the slowest growing segments. Today, with so many different models and makes on the market, and at relatively low price points, this is a classic commodity market. Low-end instruments are experiencing reduced demand except in environmental testing, where such instruments are tied to prepackaged reagents and kits. Scanning UV–vis and diode-array instruments, faster and more powerful instruments at marginally higher prices, offer the best prospects for replacing older, lower performing instruments as they are retired.

IR and near-infrared (NIR) instruments represent about 26% of the molecular spectroscopy market, and both are experiencing moderate growth at about 5%. These days, the IR market is composed primarily of Fourier-transform (FT) instruments as opposed to dispersive units, and many are outfitted with microscopes for targeting. FT-IR instruments are more suited to inorganic analysis, while NIR instruments are better for organic analysis. Accordingly, both IR and NIR spectroscopy find use in the pharmaceutical, biotechnology, and organic chemicals industries, which will help to provide consistently moderate growth, although NIR also sees strong demand from the agriculture and food industries. Tangential growth for IR, and particularly for NIR, will come from process applications outside the laboratory in areas such as food process monitoring and process analytical technology (PAT) in the pharmaceutical and biotechnology industries. The development of these uses outside the laboratory market will lead to a moderate increase in demand for both IR and NIR in methods development applications in the laboratory.

Table I: Spectroscopy product growth prospects for 2007

Colorimetry, or color measurement, will see moderate growth of around 4% because it is closely tied to industrial activity. Colorimetry is most heavily used in industries such as printing —graphics, textiles, paints, and pigments — where it is needed to maintain consistent color in publications and consumer products, although there is some use in the food and pharmaceutical industries, where color is an indicator of food quality and dosage amounts. More advanced color spectrophotometers have now taken over the colorimetry market, with the market for filter colorimeters rapidly declining.

Spectrofluorometers and luminometers are expected to experience marginal growth of about 3%, as microplate readers with multiformat technologies including fluorescence and luminescence command a larger share of the market because they can handle much higher sample throughputs. Fluorescence sensitivity offers advantages for in-situ analysis, such as live cells, which makes it popular in clinical applications. It is especially good at detecting small changes in ion concentrations.

Figure 5: Spectroscopy market by product segment.

Raman spectroscopy, a specialty technique, continues to experience above-average demand, with growth in 2007 expected to approach 10%. Raman is very adept at analyzing compounds that contain nonpolar bonds, which is ideal for polymer analysis. Raman is also very useful in the characterization of pharmaceutical excipients, as well as final dosage forms, and it also can analyze chemical structures. Raman is very complementary to FT-IR, but it has the advantage of being much less affected by the presence of moisture.

Atomic Spectroscopy

The market for atomic spectroscopy instruments is robust and is predicted to grow at well over 5% in 2007, consistent with the trend of the last few years. However, within this $2.4 billion market, there are significant differences among the various product segments. Market demand for atomic spectroscopy instrumentation has been particularly impacted by the boom in minerals and metals prices, as well as by recently enacted environmental regulations, although these positive effects differ based upon the capabilities and usefulness of individual spectroscopic methods to meet analytical requirements. In addition to application-based market forces, the expanding markets in China, India, and other emerging market countries are shifting the regional demand that suppliers are attempting to address.

Figure 6: Estimated growth by spectroscopy sector for 2007.

The atomic spectroscopy market comprises various techniques that perform elemental analyses, and it is therefore customary to associate such analyses with old-line industries such as primary metals, metal fabrication, and environmental testing, especially for water quality. Fortunately, the metals sector is beginning to take on modest characteristics of a genuine growth business, which has had a decidedly positive impact. As the result of a worldwide expansion in manufacturing activity, especially in China and India, the metals industry has boomed in terms of production and profits, and instrument purchases have increased, with arc-spark, elemental analyzers, and X-ray techniques particularly benefiting. However, techniques such as atomic absorption and ICP exhibit combined market growth currently estimated at less than 2% per year. These techniques, while broadly based, are primarily tied to municipal water testing applications where budgetary constraints limit replacement purchases and near-term prospects are less bright (except in developing regions such as China and Eastern Europe).

Perhaps the greatest contrast in market growth can be found in the two largest product segments, XRF and atomic absorption (AA). XRF has undergone explosive growth over the past few years and now represents a full quarter of the atomic spectroscopy market. This growth has come from increasing adoption of newer X-ray technology in its traditional materials science markets, but is due much more to the influence of the European Union's RoHS rule and similar environmental requirements in other areas. Manufacturers of electronics worldwide have adopted XRF, particularly handheld XRF, as the most applicable tool for compliance. Growth will exceed 10% for XRF and sales of handheld units alone should exceed $150 million in 2007. In contrast, the market for AA resembles the market for more traditional techniques. Although environmental regulations also benefit AA, the installed base in the developed world is already large, while instrument prices in China and India, where demand is strong, are low due to global and domestic competition. The net result is that the dollar value of the market is decreasing, though at a fairly negligible rate.

ICP spectrometry generally offers greater throughput potential than AA instruments and is more sensitive than flame AA, but somewhat comparable to graphite furnace AA. But like AA, it is environmentally focused and is a higher cost technique. Water testing at independent test labs is its largest market, but water works and government regulatory agencies are also major users. Petroleum testing and trace metals analysis are also important applications. Glow-discharge spectroscopy, used for solid metal samples, has experienced a bit of a renaissance because of the more intense interest in metal analysis. So the market for ICP is still expanding minimally, but bracketed by lower cost AA techniques and more sensitive ICP-MS instruments.

Although ICP-MS has applications in the pharmaceutical industry, it is benefiting much more broadly from environmental testing and process water testing, especially for semiconductor processing applications. As the most sensitive atomic spectroscopy technique, ICP-MS is used when no other instrument will do; and as regulatory limits fall, ICP-MS will likely have more and more work to do. Last year the U.S. Environmental Protection Agency lowered arsenic limits from 10 ppb to 5 ppb, which relegated that application to ICP-MS, a boon to ICP-MS but a loss for ICP.

Like XRF, X-ray diffraction (XRD) offers exceptional growth prospects, but for entirely different reasons. Although it has important applications in materials science and fatigue testing of metals, XRD is the atomic spectroscopy technique with the biggest connection to pharmaceutical research. Using single-crystal XRD, pharmaceutical scientists can determine the structure of pharmaceutical molecules and proteins, as well as monitor the changes in structure and phase that result from the application of heat. In addition, compound identification and shelf-life determinations are important pharmaceutical applications. Such life science applications form a strong source of growth for XRD.

Elemental analyzers are specific-purpose instruments for the analysis of a limited number of elements. These instruments can be segregated into two categories: organic analyzers and inorganic analyzers. Organic analyzers include total organic carbon (TOC), CHN and protein, and sum parameters analyzers (total and bound nitrogen and extractable organic halogens). Inorganic analyzers are used for carbon–sulfur determinations and for mercury, arsenic, boron, and cyanide analysis. Organic analyzers, especially TOC analyzers, exhibit demand growth of over 7% per year, twice that of inorganic analyzers. Pharmaceutical and semiconductor water analysis, as well as food-related applications, drive this market, while metals composition and trace metals analysis are key application areas for inorganic analyzers. Although organic analyzers have enjoyed good growth for a number of years, recent interest in metals analysis has given new life to this mature technique.

Arc-spark optical emission spectroscopy is the smallest analytical segment in atomic spectroscopy, and until recently was a declining business in terms of new instrument shipments. High metals prices have encouraged manufacturers to upgrade their facilities in the U.S., Europe, and Japan, while new installations in China and India have shifted interest to that region. Still, the market is very mature and growth will be minimal, with a focus on replacement sales and aftermarket purchases.

Mass Spectrometry

MS continues to be the growth leader in spectroscopy as the various MS products take on progressively more challenging analytical applications in the laboratory. The worldwide market for mass spectrometry approached the $2 billion mark in 2006 as revenues increased at more than 9%. Performance for 2007 should be almost as strong. MS's popularity is clearly a function of its utility, but interest in the technique has also intensified because of the rapid pace of new product introductions that promise greater sensitivity, speed, and throughput — and sometimes at very attractive prices.

Single quadrupole LC–MS instruments are growing in popularity because they are more affordable than higher priced tandem LC–MS products and can address routine applications for quality control and environmental analysis very efficiently. This is the result of mass detector innovations, as well as the teaming with the new generation of fast LC systems that can increase sensitivity and speed of analysis. The tandem LC–MS market is expected to be equally as strong since it is where most of the recent major technological advancements in MS have taken place.

New product introductions arrive at shorter and shorter intervals and feature greatly enhanced performance. Although the matrix assisted laser desorption ionization–time of flight (MALDI-TOF) market has settled into a lower level of steady growth, it continues to find favor among various customer groups, especially in the biotech and clinical fields. The FT-MS market is the smallest but fastest growing of the six major MS categories. Magnetic sector instruments are the exception in the MS market, with minimal to flat growth in demand. GC–MS should benefit from increased opportunities in the petroleum and petrochemical industries as well as from environmental initiatives.

The field of MS is one in which high performance seems to be the primary purchasing motivation. MS users, and even molecular biologists, appear not to be able to resist the allure of higher performance, especially sensitivity. Based upon extensive customer interactions, MS suppliers continue to introduce new high-resolution mass spectrometers at a steady pace, even in the face of growing cost concerns. Fortunately, these new mass spectrometers often hit the market just as scientists grapple with technical challenges in the laboratory for which these instruments seem to be a godsend. Although large pharmaceutical firms have moderated their appetites for costly instrumentation, small firms and generic manufacturers, as well as biotech laboratories, are still ready and willing to adopt these new techniques.

The TOF LC–MS market comprises quadrupole (Q)-TOF, LC-TOF, and Q(ion trap)-TOF instruments that feature the high resolution, mass range, and scan speed of TOF analyzers. These instruments are especially applicable to the requirements of the pharmaceutical and biotechnology industries. The Q-TOF category is the largest and is locked in a battle with FT-MS instruments for proteomics applications. Annual growth is estimated at 10%.

Tandem LC–MS includes triple-quadrupole and ion-trap mass spectrometers, but does not include the associated HPLC frontends. Technological advancements have been rampant in what is by far the largest MS market, with major performance enhancements in triple-quadrupole and ion-trap technology. The pace of advancements in the pharmaceutical and biotechnology industries continues to be the main driver of the rapid development in tandem LC–MS and should bring this segment to about $700 million in revenues in 2007.

The MALDI-TOF market is continuing to experience a transformation from linear and reflectron instruments toward higher performance tandem systems, including TOF–TOF, and Q-TOF instruments configured as MALDI-TOF instruments. This evolution in product type has provided this market with real growth potential in a significantly higher performance niche in MS, especially because these tandem instruments sell for more than $500,000 each.

Although a significant market has existed for decades, worldwide demand has doubled over the last two years, and annual growth should be in double digits for several more years. The development of tandem FT–MS systems, the introduction of the Orbitrap mass analyzers by Thermo Electron, lower average prices, reduced operating costs, and significant improvements in system and software design have brought this technique into the mainstream. Enhanced ease-of-use has been a decidedly important consideration, especially to scientists without an MS background.

Magnetic sector mass analyzers form the one area of laboratory MS that has not experienced any significant growth in demand in several years. Actually, the service business offers the strongest growth because many instruments have long useful lives and require periodic service of a highly technical nature. Although magnetic sector instruments still hold an advantage over other MS techniques in terms of mass resolution, their size and high cost is a significant drawback. Unit demand for isotope ratio instruments has grown, but as average prices have fallen, revenue increases have been slow to follow.

Like the LC–MS categories, the market estimates for GC–MS do not include the associated GC demand. The demand for GC–MS is distributed broadly across many industries, with the pharmaceutical and biotech sectors accounting for only about 10% of the market, quite unusual as compared to other MS techniques. This diversity leads to a modest growth potential of about 5% in this $400 million market.

Solving Societal Problems and Addressing Global Opportunities

The world of spectroscopy is populated by a variety of technologies, some old, some new, that can be found today in many of the most challenging sectors of the global economy. Who would have speculated that an X-ray technique would be industry's solution to helping reduce lead contamination of waste disposal sites and nearby groundwater? But fortunately, modified versions of handheld instruments developed years ago to detect lead-based paint in older homes were the genesis of these new instruments. XRF instruments, both handheld and benchtop units, are now one of today's growth segments as they screen for lead-based solder in printed circuit boards throughout the world.

Raman spectroscopy, once an obscure technique, is becoming a solution to analytical problems that cannot be adequately addressed by FT–IR or NIR instrumentation. From authenticating diamonds, to characterizing pharmaceutical compounds, to PAT solutions to improve pharmaceutical manufacturing, Raman is the choice of scientists and engineers.

And how much longer would we need to wait to discover new groundbreaking pharmaceutical compounds without the aid of tandem LC–MS, TOF-LC-MS, and FT-MS instruments. These and a dozen other examples are why spectroscopy instruments are the leading technologies that the world is dependent upon. Of course, this did not just happen by accident. Product innovations, applications development, and technological augmentation have allowed the instruments we rely on to become a reality. Reconciling customer preferences with the evolving demands of regulatory requirements is a continuing challenge. This, coupled with the need to make each instrument easy to use, fast, and inexpensive, makes life interesting for instrument manufacturers. Much work still lies ahead, but the successes thus far achieved attest to the growing demand for these techniques.

As the world develops, spectroscopy technology is rapidly finding its way into markets that a few years ago barely existed. Today spectroscopy suppliers from around the world are shifting their manufacturing and marketing strategies to better address these global opportunities. China is the most obvious example, where indigenous suppliers and foreign firms help to bring important technology to its rapidly expanding economy. China is a big potential market, but it is also a source of efficient manufacturing that will likely be a major future supplier of innovative instrumentation to global markets. In fact, it is already becoming a player on the world stage.

Lawrence S. Schmid is President and Chief Executive Officer of Strategic Directions International, Inc. For more information on Instrument Business Outlook or other instrumentation research, contact Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax; (310) 641-8851, E-mail: sdi@strategic-directions.com