Article

Spectroscopy

Spectroscopy

Market Profile: Fluorescence Correlation Spectroscopy

Fluorescence correlation spectroscopy (FCS) is a relatively new and advanced subsegment of the fluorescence spectroscopy market. FCS can provide a wealth of very specific physiochemical information that is most useful to those in biology and related sectors.

Fluorescence correlation spectroscopy (FCS) is a relatively new and advanced subsegment of the fluorescence spectroscopy market. FCS can provide a wealth of very specific physiochemical information that is most useful to those in biology and related sectors. Recent technical advancements have allowed the FCS market to begin to develop rapidly.

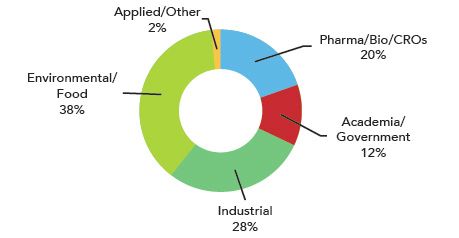

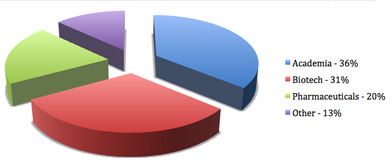

Fluorescence correlation spectroscopy demand for 2011

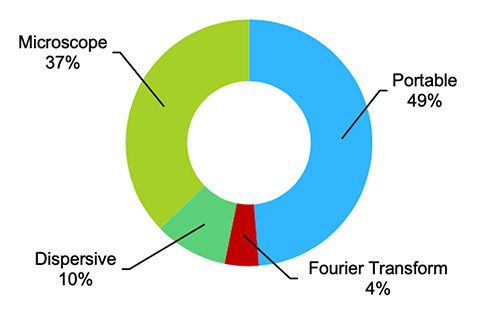

FCS measures the fluctuation of fluorescence of very small particles and molecules, and can provide both the concentration and size of the particles or molecules being analyzed, as well as a wealth of other physiochemical information. FCS systems are typically integrated microscopy systems, but some are sold as stand-alone detectors that can be connected with a microscopy system of choice. Configurations and system prices can vary widely, largely depending on the number and types of lasers used.

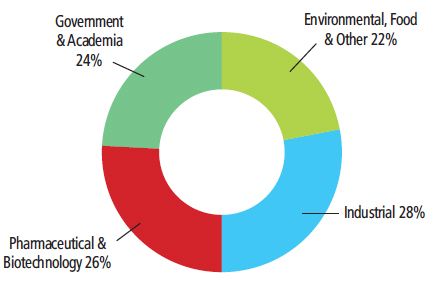

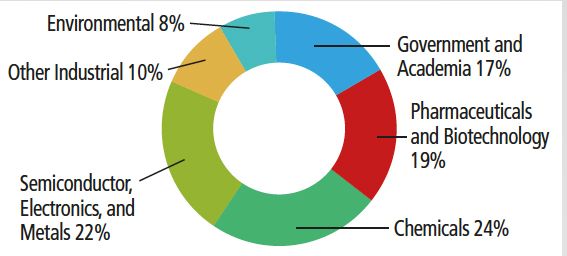

FCS can determine properties such as diffusion coefficients, average concentrations, and reaction rates, and it is attractive for drug discovery and development applications. One of the biggest strengths of the technique is characterizing the mobility-related parameters of relevant biological molecules. The strongest demand for this relatively new technique is still largely centered on academic institutions performing basic research.

Although first developed in the 1970s, early systems were extremely complex to operate and faced a number of performance limitations. Technological improvements that came about in the mid-1990s allowed for the development of much more user friendly commercial instruments. The annual worldwide market for FCS is still less than $5 million, but it should have strong double-digit growth over the next several years as more competitors enter the segment and it becomes a more widely accepted analytical technique.

The foregoing data were based on SDi’s market analysis and perspectives report entitled Global Assessment Report, 11th Edition: The Laboratory Life Science and Analytical Instrument Industry, October 2010. For more information, contact Stuart Press, Vice President – Strategic Analysis, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax: (310) 641-8851, www.strategic-directions.com.

Newsletter

Get essential updates on the latest spectroscopy technologies, regulatory standards, and best practices—subscribe today to Spectroscopy.